Small Business K1 Form

Each partner is responsible for filing an individual tax return reporting their share of income losses tax deductions and tax credits that the business reported on the informational 1065 tax form. Rather than entering the proceeds of the sale of qualified small business stock on line 9a of your K-1 enter the figure under stock sales in order to indicate that the sale was qualified small business stock Its not going to matter that the entry is not on the K-1.

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Start a free trial now to save yourself time and money.

Small business k1 form. For example if the corporation earned 10000 in ordinary business income and had 5 shareholders with equal shares you would report 2000 in ordinary business income on Line 1 of Part III of each shareholders K-1. Current Revision Schedule K-1 Form. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

A copy of the amendment form for your business type for the year you are amending the 2019 amendment form for amending a 2019 return for example A copy of the return you are amending including all supporting forms and schedules like Schedule C or Schedule K-1 and any worksheets you completed. The K-1 tax form is a supplementary form that assists owners of small businesses in filing their personal taxes. However being a corporation the S-Corp must file Form 1120S US.

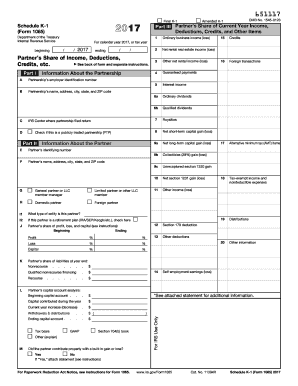

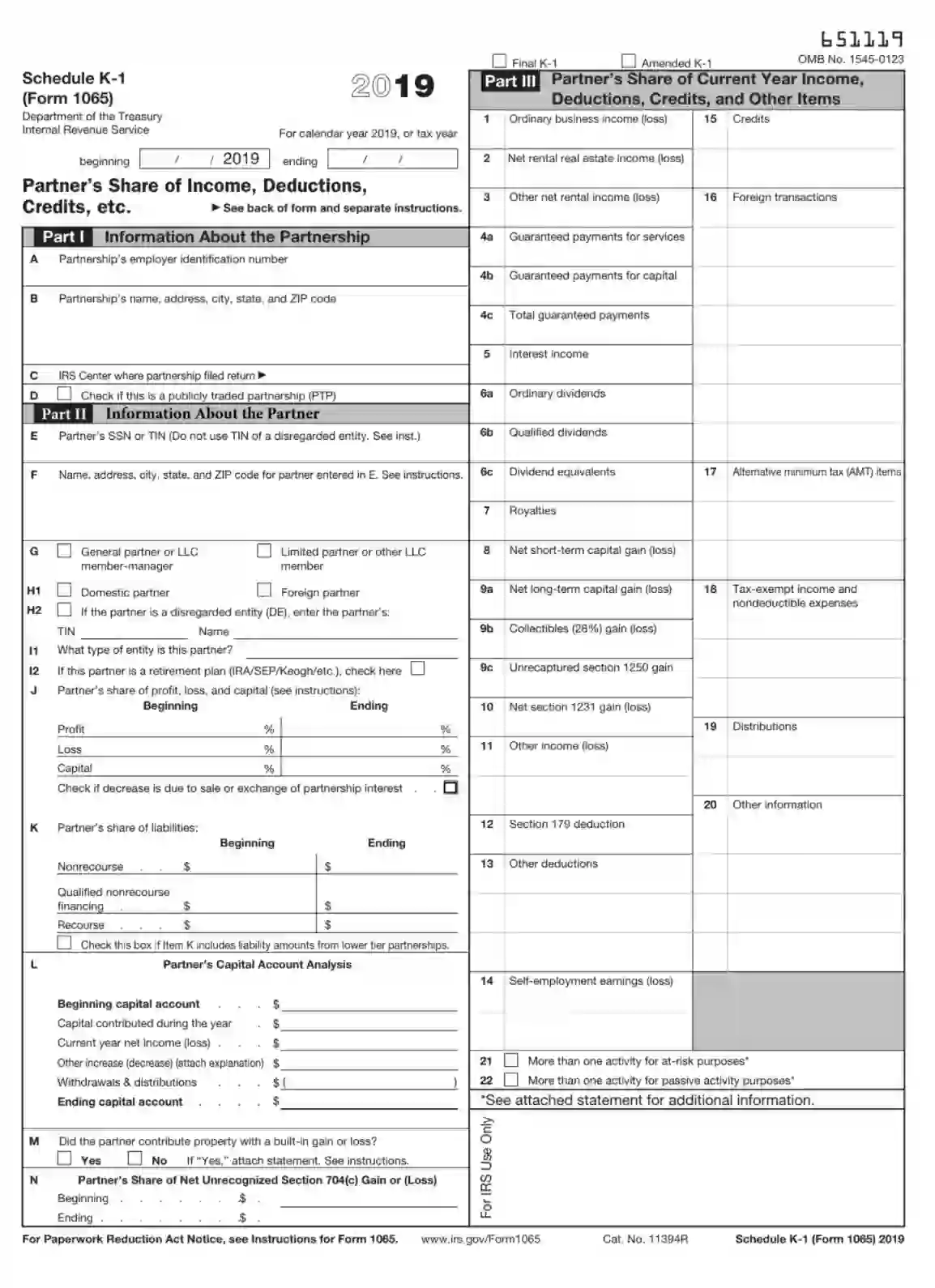

A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. IRS Schedule K-1 is a document used to describe the incomes losses and dividends of a businesss partners or an S corporations shareholders.

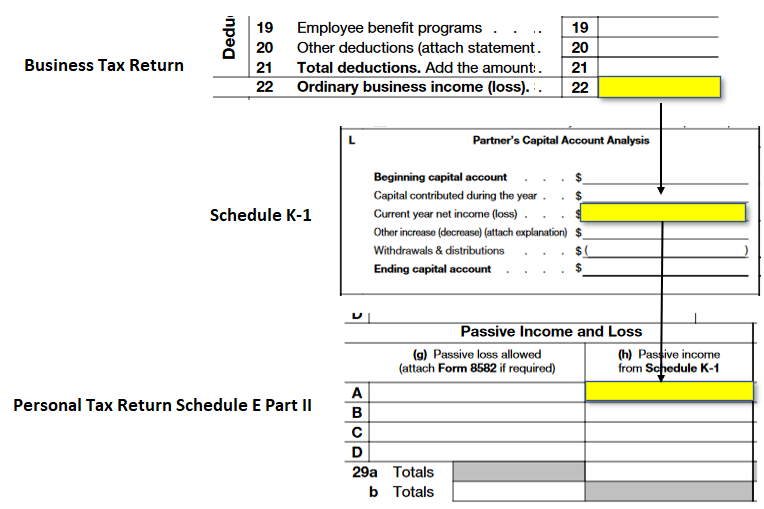

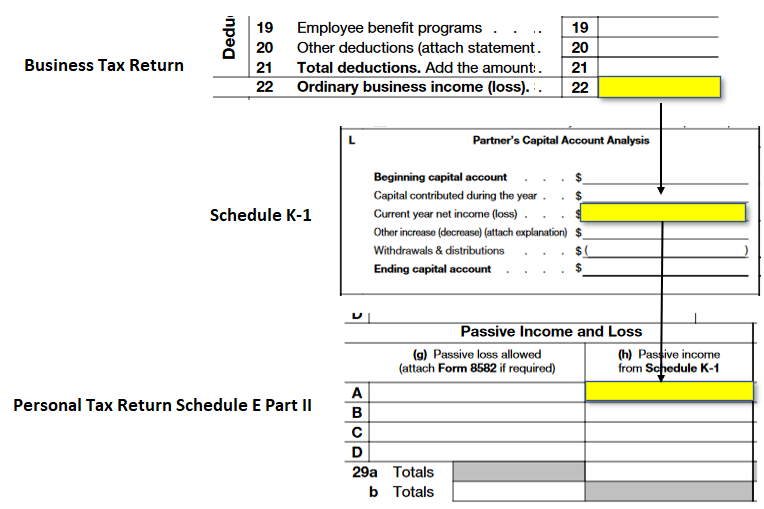

Use the amount on Line 21 of your Form. Part of that form requires filling out and issuing Schedule K-1s. Schedule K-1 Form 1065 is used for reporting the distributive share of a partnership income credits etc.

K-1 Forms for business partnerships For businesses that operate as partnerships its the partners who are responsible for paying taxes on the business income not the business. The partnership files a copy of Schedule K-1 Form 1065 with the IRS to report your share of the partnerships income deductions credits etc. Instead the business income flows through to the partners or shareholders who then file and pay tax on any income.

What is Schedule K-1. The purpose of the Schedule K-1 is to report each partners share of the partnerships. S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to the owners on their personal tax returns.

For example shareholders must be an individual and cannot be another entity like another corporation or an LLC. The form reports the income and other information about the business and you use it. What is a Schedule K-1 Form.

Get the latest articles info and advice to help you run your small business. Current Revision Schedule K-1 Form. Available for PC iOS and Android.

S-Corp shareholders have several unique restrictions. Income Tax Return for an S Corporation and issue K1 s even if it has only one shareholder. The K-1 is prepared by the entity to distribute to ownersshareholders to.

With this tax form the business can also track the participation of each partner in the business performance depending on how much capital was invested. A Schedule K-1 is a tax form that reports how much income losses deductions and credits were passed through to your companys shareholders or partners based on how much of your business they own. So each year when tax season rolls around partnerships must file Form 1065 with the IRS.

Filed with Form 1065. The S corporation files a copy of schedule k-1 Form 1120-S with the IRS to report your share of the corporations income deductions credits etc. Form 1065 is an information return used to report the income gains losses deductions credits etc from the operation of a partnership.

A partnership does not pay tax on its income but passes through any profits or losses to its partners on a Schedule K-1. The S corporation files a copy of this schedule with the IRS to report your share of the corporations income deductions credits etc. Fill out securely sign print or email your Schedule K 1 2017-2020 Form instantly with SignNow.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income. Schedule K-1 is the tax form used by partners and shareholders to report to the Internal Revenue Service their income losses dividends or capital gains during the fiscal year. If you are an owner of a partnership LLC S-corp or other entity that passes through taxes to its owners in most cases you will receive a K-1 form each year.

Schedule K-1 is an Internal Revenue Service IRS tax form issued annually for an investment in a partnership.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Form 1065 And Your Schedule K 1 Everything You Need To Know Picnic S Blog

K1 Form Fill Out And Sign Printable Pdf Template Signnow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs Schedule K 1 Form 1065 Fill Out Printable Pdf Forms Online

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

What Is A Schedule K 1 Form Zipbooks

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs Form 1120s Definition Download 1120s Instructions

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

Understanding The 1065 Form Scalefactor

What Is A Schedule K 1 Form Zipbooks

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Posting Komentar untuk "Small Business K1 Form"