K1 Ordinary Business Income Tax Rate

Because partnerships are so-called. Another very simple example might occur if the S Corp originally purchased and now operates an antique store.

Doing Business In The United States Federal Tax Issues Pwc

Part II Loans from shareholder Beginning of the year 3473.

K1 ordinary business income tax rate. In this case heshe may have been taxed on the income but did not pay out any of the income for some business reason meaning the borrower cannot use this income. However for 2011 the rate is reduced to 133. The SE tax is an additional tax of 153 that is levied on an individuals SE income in excess of 400.

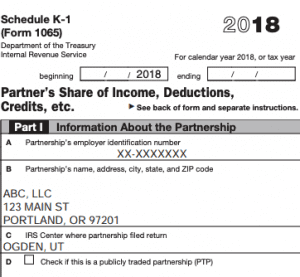

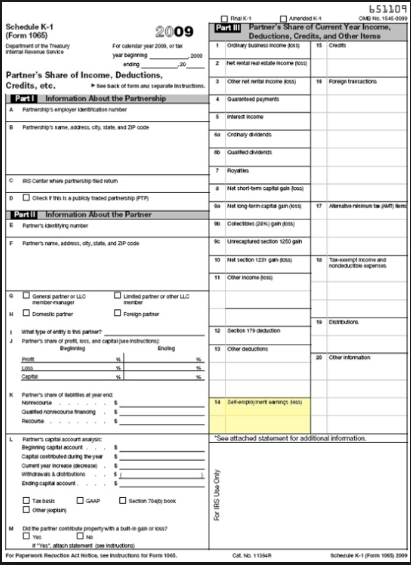

This is the K1 information. The Schedule K-1 document. Schedule K-1 is a tax document similar to a W-2 form.

This means for box 16 entries in D and I passive category are. That is a 1400 difference. The self-employment tax rate for self-employment earnings is generally 153.

Your 20000 gain would be taxed as ordinary income. These are funds paid to the BDC from investments in common. How to read a K-1 Form 1065.

We received a K1 and ordinary income in box 1 and. Business development companies. I received a Schedule CT K-1 which includes a tax liability amount in Part III line 1.

Actually having retained income is proof positive that the borrower may have earned income in the business showing on K-1 lines 123 but did not receive the income which is what FNMA and FHLMC require. Is k1 income taxed as ordinary income. Taxpayers receive a Schedule K-1 Form 1065 or Form 1120S reporting their share of income from interest dividends ordinary and qualified and capital gains net short-term and net long-term from partnerships and corporations.

Trusts and estates that have distributed. Income distributed to you via Form k1 increases your basis. Get your taxes done.

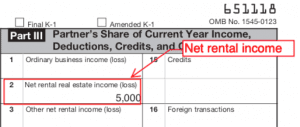

K-1 with entries for both ordinary business income and rental real estate income as well as entries under line 16 foreign transactions for both codes D and E. Another very simple example might occur if the S Corp originally purchased and now operates an antique store. Generally SE income includes income derived from any trade or business carried on by an individual plus the distributive share of income or loss from any trade or business conducted by a partnership of which the individual is a partner under the tax law.

Compare this to the 3000 bill if the gain was long-term. Income and tax liabilities are passed through the corporation or entity to the taxpayer. The 20000 gain would be taxed at 22 for a total tax bill of 4400.

So your 600K of proceeds will be partly capital gain probably and partly possibly only a little bit ordinary income. This is taxed at the ordinary income rate -- your personal marginal tax bracket. Ln 1 ordinary business income 62500 Ln 4 interest income 1735.

Ordinary income is that years income that was derived by conducting the regular business of the partnership. Because partnerships are so-called. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

If you are an individual partner filing a 2020 Form 1040 or 1040-SR find your situation. Schedule K-1 is a federal tax document used to report the income losses and dividends of a business or financial entitys partners or an S corporations shareholders. Ordinary income stems from the operation of the.

On the first K-1 use the passive category only. The Schedule K-1 document. K1 ordinary business income tax rate.

Ordinary Business Income Loss The amount reported in box 1 is your share of the ordinary income loss from trade or business activities of the partnership. Showing results for. Keep in mind our job as underwriters is to analyze taxable income into useable income for borrowers.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income. Attach a statement to your federal income tax return to show your computation of both the tax and interest for a nonqualified withdrawal. 4104 Examination of Income Manual Transmittal.

Whereas the highest tax bracket or rate of 37 percent applies to capital gains. Partnerships S Corporations estates and trusts provide K-1 forms to partners and shareholders for filing their individual tax returns. Partnerships S Corporations estates and trusts provide K-1 forms to partners and shareholders for filing their individual tax returns.

Generally where you report this amount on Form 1040 or 1040-SR depends on whether the amount is from an activity that is a passive activity to you. Ordinary income stems from the operation of the store. Line 1 - Ordinary IncomeLoss from Trade or Business Activities - Ordinary business income loss reported in Box 1 of the K-1 is entered.

Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax. 153 percent on the first 117000 29 percent on the next 83000 after 117000 and 38 percent on income over 200000. Ordinary business income enter losses in Part III.

Include the tax and interest on Schedule 2 Form 1040 line 10. K1 ordinary business income. K1 ordinary business income.

These withdrawals are taxed separately from your other gross income at the highest marginal ordinary income or capital gains tax rate.

What Is A Schedule K 1 Form Zipbooks

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

Form 1065 And Your Schedule K 1 Everything You Need To Know Picnic S Blog

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

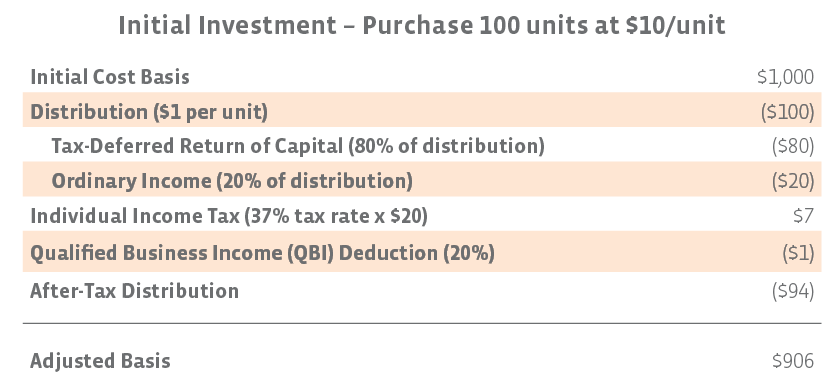

Mlp Taxation The Benefits And What You Need To Know

3 0 101 Schedule K 1 Processing Internal Revenue Service

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

What Is A Schedule K 1 Form Zipbooks

Simple And Complete Guide To S Corporations Online Tax Professionals

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Mlps And K 1s And Ubti Oh My Seeking Alpha

Posting Komentar untuk "K1 Ordinary Business Income Tax Rate"