How To Calculate Excess Business Interest Expense

Any computed excess business interest expense excess taxable income or excess business interest income will automatically flow to Schedule K and K-1. If a partnerships business interest deduction is limited under 163j the amount of BIE that is disallowed because it exceeds the 163j limitation excess BIE must be allocated to and carried forward by each partner and it reduces the partners basis in its partnership interest.

Https Www Irs Gov Pub Newsroom Lbi Tcja Participant Guide 163j 13301 Pdf

Any interest in excess of those amounts is limited to 30 of adjusted taxable income.

How to calculate excess business interest expense. The expense is a separately stated item. Be aware that business interest income and expense dont include investment interest income or expense. That is not where the deduction is taken.

Excess taxable income generally is the excess of ATI over the allowable interest deduction. The ATI limitation is determined at the filer level ie federal consolidated group partnership S corporation etc. If the partner has an amount here they are required to file Form 8990.

Election for a taxpayer to use its ATI for the last taxable year beginning in 2019 to calculate its 163j limitation for taxable year 2020. Disallowed business interest expense is the amount of business interest expense for a tax year in excess of the amount allowed as a deduction for that tax year under the Sec. A business can deduct its business interest only to the extent of the sum of its business interest income 30 of its adjusted taxable income and its floor plan financing income.

If Form 8990 computes that some or all interest expense is disallowed the allowed interest expense must be manually prorated and then entered as interest in the affected areas of the return. State Provision The business interest expense deduction under Code 163j remains at 30 of adjusted taxable income as calculated on a separate entity basis. Treatment of disallowed business interest expense carryforwards.

That form is used to compute the deductible amount of the excess. Box 20 code AE. The partner will enter the amount on their Form 8990 Schedule A line 43 c.

The amount of your disallowed interest expense equals the difference between the businesss total business interest expense and the deductible amount calculated in Step 5. Excess taxable income is defined as the excess if any of 30 percent of the partnerships ATI over the partnerships business interest expense grossed up to take into account that it is measured based on 30 percent of ATI. For tax years beginning after December 31 2017 Section 163 j of the Internal Revenue Code limits the deduction of business interest to business interest income plus 30 percent of adjusted taxable income plus floor plan financing.

The nondeductible amount of business interest expense is treated as excess interest that may be carried forward indefinitely and re-enters the limitation calculation for the ensuing tax years. Computation of section 163 j limitation. For partners election out of deducting 50 percent of excess business interest expense EBIE without limitation for taxable years beginning in 2020.

Adjusted taxable income means taxable income computed without regard to. For more information see Proposed Regulations sections 1163 j-1 through 1163 j-11. Use Form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year.

Excess business interest expense is the amount of disallowed business interest expense of the partnership for a taxable year. Disallowed interest expense may be carried forward indefinitely. 2019 C-Corporation Income Tax Return You must add the amount of business interest expense deducted on the federal return in excess of the 30 limitation on.

The limitation is determined at. This amount is then carried forward to future tax years indefinitely and treated as business interest expense incurred in the carryforward year. Business interest in excess of the limitation can be carried forward indefinitely.

Per the IRS Form 1065 instructions box 13k is the amount from Form 8990 Part II line 32 for excess business interest expense.

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

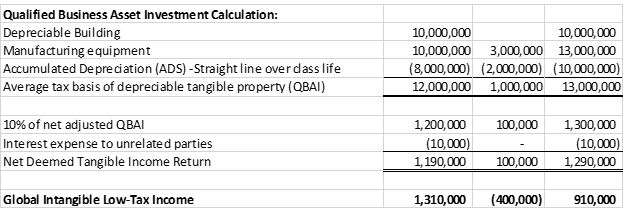

Global Intangible Low Tax Income Working Example Executive Summary Mksh

The Section 163 J Business Interest Expense Limitation 2021 Final Regulations Impact On Self Charged Interest For Partnerships Marcum Llp Accountants And Advisors

Instructions For Form 8990 05 2020 Internal Revenue Service

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Intrest Rate Finance

Payment In Kind Pik Interest Multiple Expansion

Https Www Irs Gov Pub Irs Utl 2019ntf 08 Pdf

0369ae03 8998 478d 8581 D89e12b7d9c3 English Writing Skills English Vocabulary Words Learn English Words

Instructions For Form 8990 05 2020 Internal Revenue Service

How Do Operating Income And Revenue Differ

Interest Expense Formula Calculator Excel Template

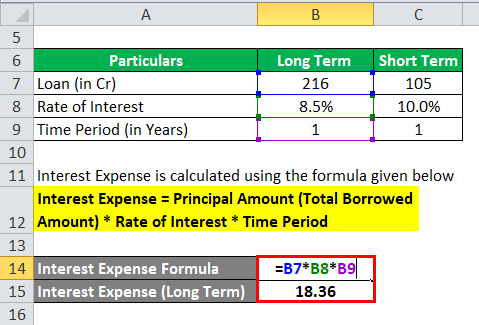

Interest Expense Formula Calculator Excel Template

Business Math How To Calculate Pay Raise By Percentage Hr For Small Business Pay Raise Real Numbers Math

Ba Interview Preparation Watch List Business Analysis Business Analyst Tools Business Management Degree

Components Of The Income Statement Accountingcoach

Https Samples Breakingintowallstreet Com S3 Amazonaws Com Ibig 04 04 Equity Value Enterprise Value Metrics Multiples Pdf

Income Statement Forecasting Guide Wall Street Prep

Posting Komentar untuk "How To Calculate Excess Business Interest Expense"