Does Passive K-1 Income Qualify For Qbi

Does passive k 1 income qualify for qbi. So their deduction is.

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

His K-1 Form 1120-S shows items which comprise qualified business income of 40000.

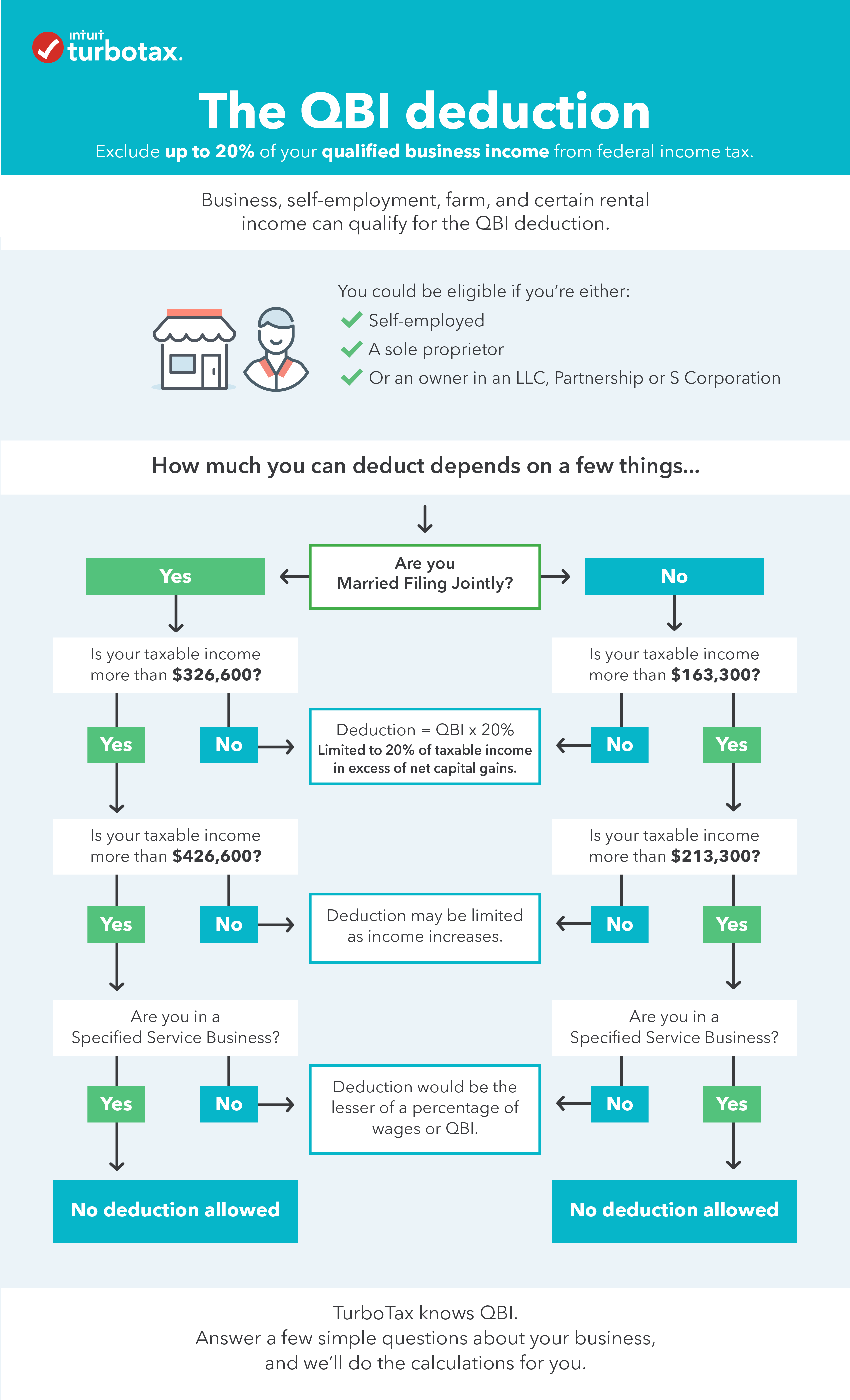

Does passive k-1 income qualify for qbi. Below the threshold 20 of QBI limited to 20 of taxable income 2. GlobalRentalSite is a trustworthy platform that provides essential information about rental services. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017.

Qualified business income or QBI is the net income generated by any qualified trade or business under Internal Revenue Code IRC 162. And in my research I found somewhere I dont remember where. The 2017 pal is the older previously disallowed pal and is otherwise allowed against passive income in the current tax year.

For 2019 the taxable income thresholds will 321400 for married filing jointly 160725 for married filing separate and 160700 for all other filing statuses. If you have an interest in Affiliate Marketing or building an Online Business as a whole however do not recognize where to start after that this new program Freedom Breakthrough The Affiliate Blueprint Academy from Jonathan Montoya is well worth a look. April 5 2021 by ts1.

Rental properties are usually treated as passive activities and passive activities are excluded from the definition of a qualified trade or business. The QBI deduction was created by the Tax Cuts and Jobs Act of 2017 a major reform of the federal tax code. It does not qualify under Safe Harbor.

Form 8995 a qualified business income deduction. On our website you can look for does passive rental income qualify for qbi and any sort of goods you wish to rent like a vehicle a home equipment and many other things. The K1 lists the NDI in the other income section.

The taxpayers and spouses total taxable income is 200000. In example 1 qbi would equal the full 35 000 in 2019. Suggestions For Does Passive Rental Income Qualify For Qbi.

Start Sch k passive income qualify for qbi. Does Passive Income Qualify For Qbi. QBID is generally available to most taxpayers with pass-through business income whose 2018 taxable income is at or below 315000 for joint returns and 157500 for other filers.

Super Affiliate System requires no technical skill no creative talent and no office. All information is provided at no cost. Now affiliate marketing aint that complicated and can make you a.

I have gone to schedule E and linked the activity but still do not see anything flowing to K1. However S corporations and partnerships report each shareholders or partners share of QBI W-2 wages unadjusted basis immediately after acquisition of qualified property qualified REIT dividends and qualified publicly traded partnership income on Schedule K-1 so the shareholders or partners may determine their deduction. No deduction allowed for SSTB 3.

From everything I can tell this should qualify for the QBI. Super Affiliate System John Crestani. You will not have to hassle with.

Taxpayer A is a joint filer and part owner of an S-corporation. Does passive income qualify for qbi. Beginning any kind of brand-new business particularly an.

Online business and make money online with this Online Business Affiliate Marketing Tutorial For Beginners Im going to show you affiliate marketing strictly for beginners below to start an online business and learn how to make money online. The taxpayers QBI deduction is not subject to the limit for higher-income taxpayers. I cannot figure out how to get the QBI deduction on the K-1 for a 1041 Return that has non passive income land rental.

20 of TPs qualified REIT dividends and publicly traded partnership PTP income 12. Federal income tax purposes may be able to claim a QBI. The same is true for LLCs that are treated as partnerships for.

You get this special tax break called the qualified business income deduction QBI deduction simply by qualifying for it due to the nature of your business and your business income. The qbi deduction applies to qualified income from sole proprietorships partnerships limited liability companies llcs that are treated as sole proprietorships or as partnerships for tax purposes and s corporations. C income 100 000 k 1 income 100 000.

The Super Affiliate System Pro course shows you how to make a highly profitable online business. Does Passive Income Qualify For Qbi. If you are a Partner or Shareholder and file Schedule K-1 on your individual tax return you may be able to claim the Qualified Business Income Deduction QBID on that income.

It does qualify under section 162. Only domestic business income is eligible and you will probably receive a copy of Schedule K-1 if you have eligible QBI. However rentals that qualify as trades or businesses under IRC 162 are not considered passive which means they could potentially qualify for the QBI.

The deduction allows an individual to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust. As there is no participation requirement passive investors in real estate funds that are engaged in a trade or business for US.

199a b 2 amounts plus 20 of the aggregate amount of qualified real estate investment trust dividends and qualified publicly traded partnership income. Does passive k 1 income qualify for qbi. You can get passive income after you follow the steps given in the course.

The qualified business income qbi deduction is a tax deduction for pass through entities. Maybe the IRS that said passive enterprises can qualify for QBI The safe harbor is. Therefore the fund must be engaged in a real estate trade or business to pass QBI to investors.

Above the threshold 50 or 25 25. Does Passive Income Qualify For Qbi. The answer is it s not 100 percent clear but the general consensus among tax practitioners is that income from rental properties will be deemed qbi and qualify for the deduction.

Sch k passive income qualify for qbi. Income from real estate will generally qualify for the QBI deduction if the real estate activities qualify as a trade or business. The 2017 pal is the older previously disallowed pal and is otherwise allowed against.

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Limiting The Impact Of Negative Qbi Journal Of Accountancy

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Do I Qualify For The 199a Qbi Deduction

Solved Re Form 1065 K 1 Statement A Qbi Pass Through Page 2

Limiting The Impact Of Negative Qbi Journal Of Accountancy

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

What Is The Qualified Business Income Qbi Deduct

Limiting The Impact Of Negative Qbi Journal Of Accountancy

199a Tax Rules For Qualified Business Income Qbi Bader Martin

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Instructions For Form 8995 2020 Internal Revenue Service

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Posting Komentar untuk "Does Passive K-1 Income Qualify For Qbi"