Does K-1 Income Qualify For Qbi

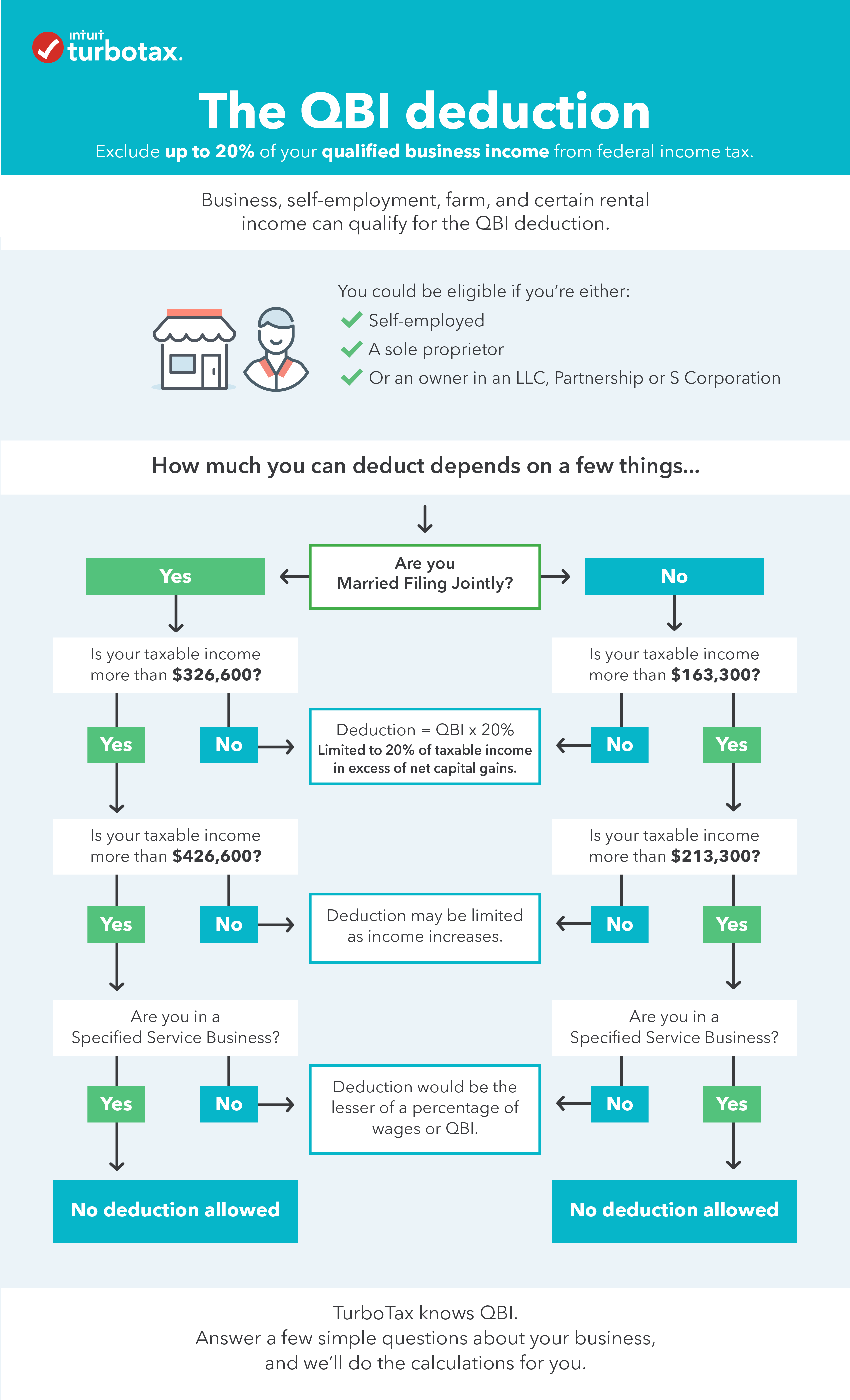

The QBI deduction was created by the Tax Cuts and Jobs Act of 2017 a major reform of the federal tax code. Do You Qualify for the QBI Deduction.

What Is The Qualified Business Income Qbi Deduct

2 dividends income equivalent to a dividend or payments in lieu of dividends.

Does k-1 income qualify for qbi. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. Your taxable income is 150000 of which 60000 is QBI. If the taxpayers income exceeds the threshold the Sec.

The qualified business income QBI deduction allows you to deduct up to 20 percent of your QBI. More specifically QBI does not include 1 any item taken into account in determining short-term or long-term capital gain or loss. The partnerships deduction for guaranteed payments will reduce the qualified business income QBI that is passed through to the partners as the guaranteed payment is properly allocable to the trade or business and is otherwise deductible for federal income tax purposes.

The regs are inconsistent when it comes to the treatment of 1231 losses treated as ordinary such losses will reduce a taxpayers QBI. If you expect to receive a 2018 Schedule K-1 containing QBI tax information then consider filing an automatic extension by April 15. If your K-1 does not contain these codes you will need to have the K-1s corrected to include this information.

Rental income declared on Schedule E and business income declared on schedule K-1 can both qualify. The taxable income limit is adjusted annually for inflation. 199Ab2 amount is the lesser of 1 20 of the QBI for each trade or business or 2 the greater of a 50 of the W-2 wages of the qualified trade or business or b the sum of 25 of the wages of the qualified trade or business plus 25 of the unadjusted basis immediately after.

If the taxpayer receives a Schedule K-1 Form 1065 with Section 199A Income in Box 20 Code Z that income amount may be subject to certain deductions to determine the Qualified Business Income QBI from that business. If a partnership or S corporation fails to provide this information the final regulations provide that each unreported income of positive QBI W-2 wages or UBIA of qualified property attributable to the entitys trades or businesses will be presumed to be zero. Items that reduce QBI from a partnership are the following.

The most important information for the QBI calculation is found in box 20. Qualified business income QBI is ordinary business income not interest dividends or capital gain from 1099-MISC Schedule C or K-1 plus qualified REIT dividends and qualified publicly-traded partnership income. Aggregate QBI or taxable income minus net capital gainslosses.

Only domestic business income is eligible and you will probably receive a copy of Schedule K-1 if you have eligible QBI. You simply multiply QBI 60000 by. The taxpayers and spouses total taxable income is 200000.

In order for the K-1 detail to be included in a QBI deduction there must be amounts in Box 17 of the SCorp K-1 form with codes in the range of V to Z. C income 100000 K-1 income 100000. Excluded from QBI are certain investment-related items of income gain deduction and loss.

If your K-1 form has amounts in Box 17 with these codes then be sure to get all the way through the K-1 form entry section in TurboTax in order for the QBI deduction to calculate. The taxpayers QBI deduction is not subject to the limit for higher-income. Form 8995-A Qualified Business Income Deduction.

Taxpayers have to calculate the QBI deduction on whichever is lower. Certain businesses are phased out of the QBI above certain income levels. It does not include the W-2 compensation of an S-corp shareholder nor the K-1 guaranteed payments paid to a partner.

However S corporations and partnerships report each shareholders or partners share of QBI W-2 wages unadjusted basis immediately after acquisition of qualified property qualified REIT dividends and qualified publicly traded partnership income on Schedule K-1 so the shareholders or partners may determine their deduction. In Drake18 enter the amount for box 20AD on the K1P screen 1065 K1 13-20 tab Qualified Business Income QBI Deduction section at the bottom right. What if my K-1 does not report the qualified business income in the correct box.

This appears to place the taxpayer in a no-win situation. When the K1 is from a PTP do not use the K199 screen to enter any information as this will result in EF message 1352. His K-1 Form 1120-S shows items which comprise qualified business income of 40000.

You must enter the codes Z AA AB and AC or as many of these codes as you have or QBI will not calculate. 1231 gains do not qualify for the 20 deduction but losses will reduce the taxpayers income eligible for the 20 deduction. Taxpayer A is a joint filer and part owner of an S-corporation.

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Limiting The Impact Of Negative Qbi Journal Of Accountancy

Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

Irs Issues Final Section 199a Regulations And Defines Qbi Engage Advisors

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Limiting The Impact Of Negative Qbi Journal Of Accountancy

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Solved Re Form 1065 K 1 Statement A Qbi Pass Through Page 2

199a Tax Rules For Qualified Business Income Qbi Bader Martin

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Qbi Deduction Examples Wilson Rogers Company

The Qbi Deduction A Simple Guide Bench Accounting

Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

Posting Komentar untuk "Does K-1 Income Qualify For Qbi"